Event insurance requirements for artists typically include:

- General liability insurance

- A certificate of insurance (COI)

- Venue listed as an additional insured

- Specific coverage amount, i.e., $2 million aggregate

You’re excited to attend an event as an arts and crafts vendor — but first, there’s the matter of understanding what the heck aggregates and additional insureds are! If your event requirements sound like another language, you’re not alone.

Learn how to confidently meet venue requirements for event insurance in seven easy steps.

What Venues Are Really Asking For

Along with things like a signed contract and sales tax permit, event organizers have specific insurance must-haves for artists and crafters. The insurance required for event venues varies, but these are the typical elements they need from you.

General Liability Insurance

When you hear you need insurance for an event, it’s most often general liability insurance. This coverage is designed to cover accidents that happen to others (like event attendees or other vendors) and property damage to the venue caused by your business.

General liability insurance = pays for things that go wrong at your booth, like:

- A customer tripping over a cord and breaking their wrist

- One of your art pieces damaging an attendee’s property

- Your booth creating an expensive hole in the venue’s wall

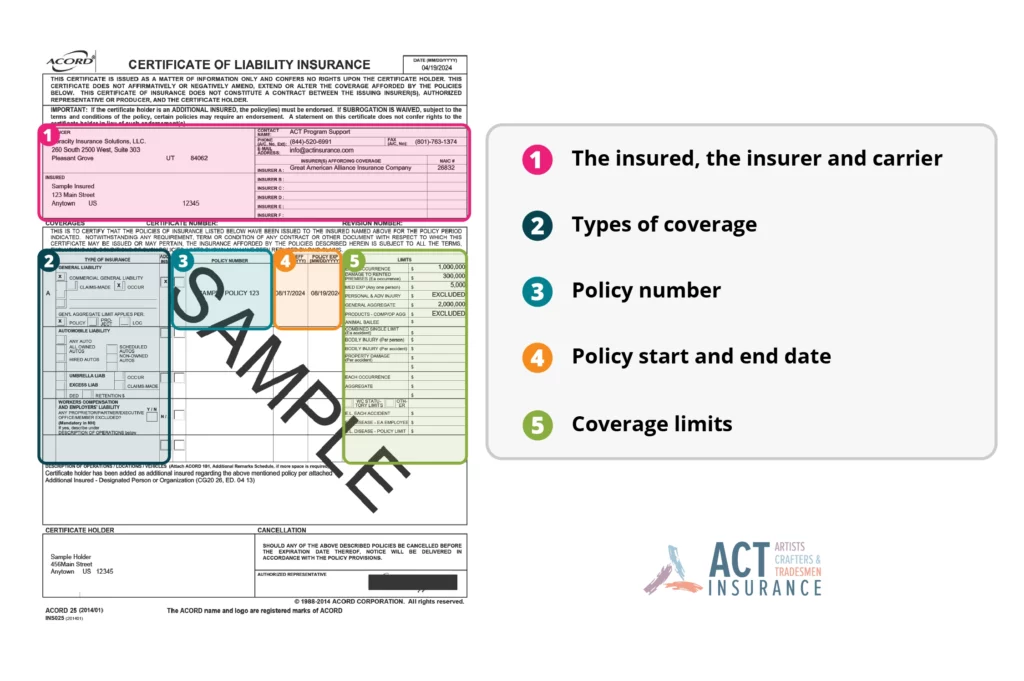

Certificate of Insurance

How do event organizers check you’re properly insured — and clear to attend? By seeing your certificate of insurance (COI), which is your proof of insurance.

Your insurer gives you a COI after you’ve purchased a policy. This document outlines the highlights of your coverage, including what kind of coverage you have, how much it covers you for, and how long it’s good for.

A certificate of insurance is also called an ACORD form. ACORD is a non-profit that standardizes insurance forms. You’ll see their logo on the top left of many COIs.

Additional Insured

The venue will also require you to add them as an additional insured on your policy. This means your coverage extends to them — essentially, the venue is insured, in addition to you!

Every event organizer will likely have their own insurance policy for the event itself. Still, they’ll also be protected as an additional insured on every attending vendor’s policy in case something goes wrong specific to one vendor.

Pro Tip:

You should only add additional insureds if asked to do so by a venue or event organizer. A friend or family member helping out at your booth is not an additional insured.

Coverage Dates

Policy Limits

A policy limit is how much coverage (money!) is available to you if you file a claim. There are two main types: occurrence and aggregate.

Occurrence limit: How much coverage you have for a single claim

Aggregate limit: How much coverage you have for the entire policy period

Each venue will have different policy limit requirements, but a common one is $1 million per occurrence and $2 million aggregate.

Think of it as the difference between one painting’s value and the worth of your entire collection. If you subtract a single piece’s price tag (occurrence), this detracts from the total amount (aggregate).

Pro Tip:

Planning on attending multiple events in a year? Annual artist insurance coverage saves you (and protects you better) in the long run. Learn more about event vs. annual artist and crafter insurance.

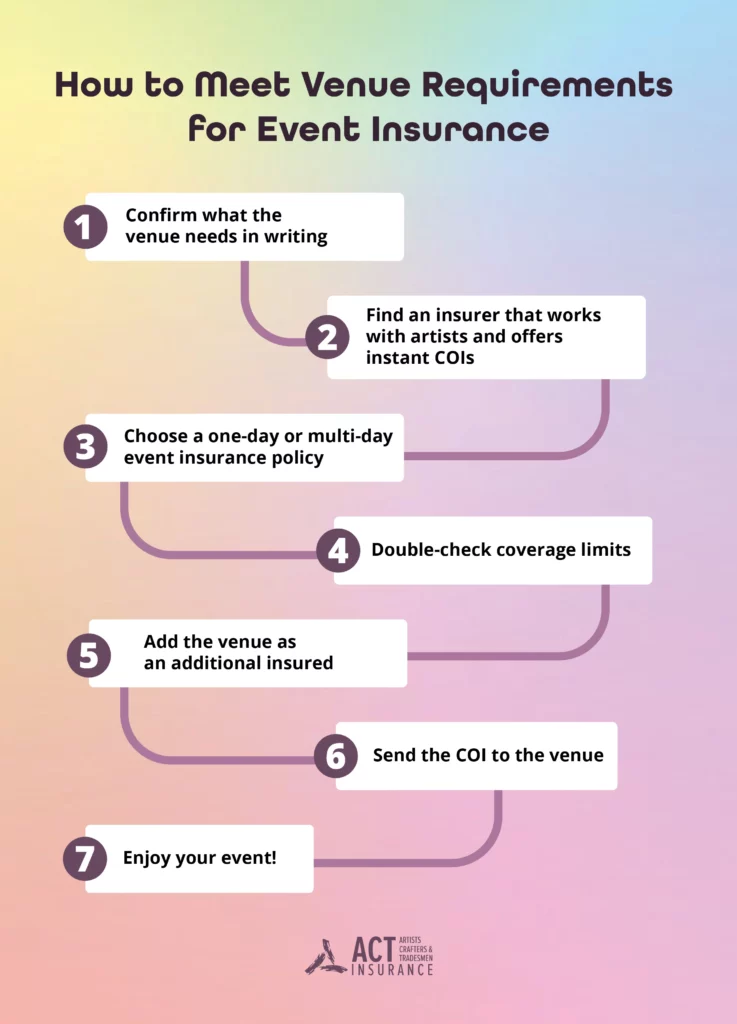

How to Get the Right Event Insurance Fast

- Confirm what the venue needs in writing: Ask the venue for their insurance requirements in writing so you know exactly what’s expected.

- Find an insurer that works with artists and crafters and offers instant COIs: Choose a provider that understands creative businesses and can issue proof of insurance once you check out.

- Choose a one-day or multi-day event insurance policy: Select coverage that matches the duration of your event to avoid gaps in protection.

- Double-check policy coverage limits: Make sure your policy meets the venue’s required limits, often $1 million per occurrence and $2 million aggregate.

- Add the venue as an additional insured: Include the venue on your policy so they’re covered too.

- Send the COI to the venue: Email the COI to your contact at the venue to show you’re officially covered.

- Enjoy your event! With insurance in place, you can focus on sharing your work and connecting with your audience.

How to Know Your Insurance Is Enough for the Event

Still wondering if your coverage is enough? The main things to look for are those policy limits. Ensure they match what the venue requires. You’ll see the occurrence and aggregate limits stated as you’re buying the policy and on your COI in the “limits” section after purchase.

Occurrence limits are usually listed first (e.g., $1M/$2M = occurrence limit requirement is $1 million).

Bonus: Ask the venue to review the COI in advance if you’re unsure. Or, check with your insurer to make sure you understand the policy correctly.

Why Venue Requirements for Event Insurance Exist

Venues require art and craft vendors to carry insurance because it transfers risk from them to your insurer. Think of all the foot traffic and product displays — lots of opportunities for accidents! Liability insurance is a safety net that keeps the event fun for everyone.

Venues also require specific policy limits because they want to ensure there’s enough coverage available if an accident occurs! That’s why you’ll often see $2 million in aggregate coverage as a standard requirement.

And why additional insureds? If someone trips over your sculpture, the blame might fall on you — but the venue could get dragged into the claim too. Organizers need the assurance they’re covered under your policy before accepting you as a vendor.

Yes, you’re required to get insurance for events, but the biggest reason you should get covered is to protect your business financially. Your creativity is worth safeguarding, and insurance gives you peace of mind to show and sell confidently.

Set Yourself Up for Success for Every Event

Ready to meet insurance requirements for your next event? ACT Insurance has you covered. Our ACT Go policy is designed to give you quick, hassle-free event coverage from $49/event!

Serious about growing and protecting your creative business? ACT Pro is the best choice for comprehensive, year-round coverage so you can stay event-ready, whatever the season. Plus, get access to additional coverages for your supplies and inventory, workshops and demos, and more!

No matter which policy you opt for, enjoy top-rated coverage crafted for you and an instant COI ready to send to venues, all at the most affordable rates around.

Attend your next event with peace of mind — just a few clicks online, from ACT.

FAQs About Event Insurance Requirements for Artists and Crafters

What Is General Liability Insurance for Event Venues?

What Documents Do I Need for Event Insurance?

The document you need to show you have the right insurance is called a certificate of insurance, or COI. This acts as a snapshot of your coverage. Event organizers typically require you to email or upload a copy of your COI.

With ACT, get an instant COI right at checkout (even on the day of the event!) to send to the venue fast.