Most solo business owners with no employees aren’t required to carry workers compensation insurance, and some states even exclude owners from coverage entirely.

We know navigating these rules can be confusing. We’re here to help you understand your state’s requirements and make sure you have the right protection for your one-person business. While you might not need workers comp yet, we’ll also help you explore other essential coverages to keep your business safe as it grows.

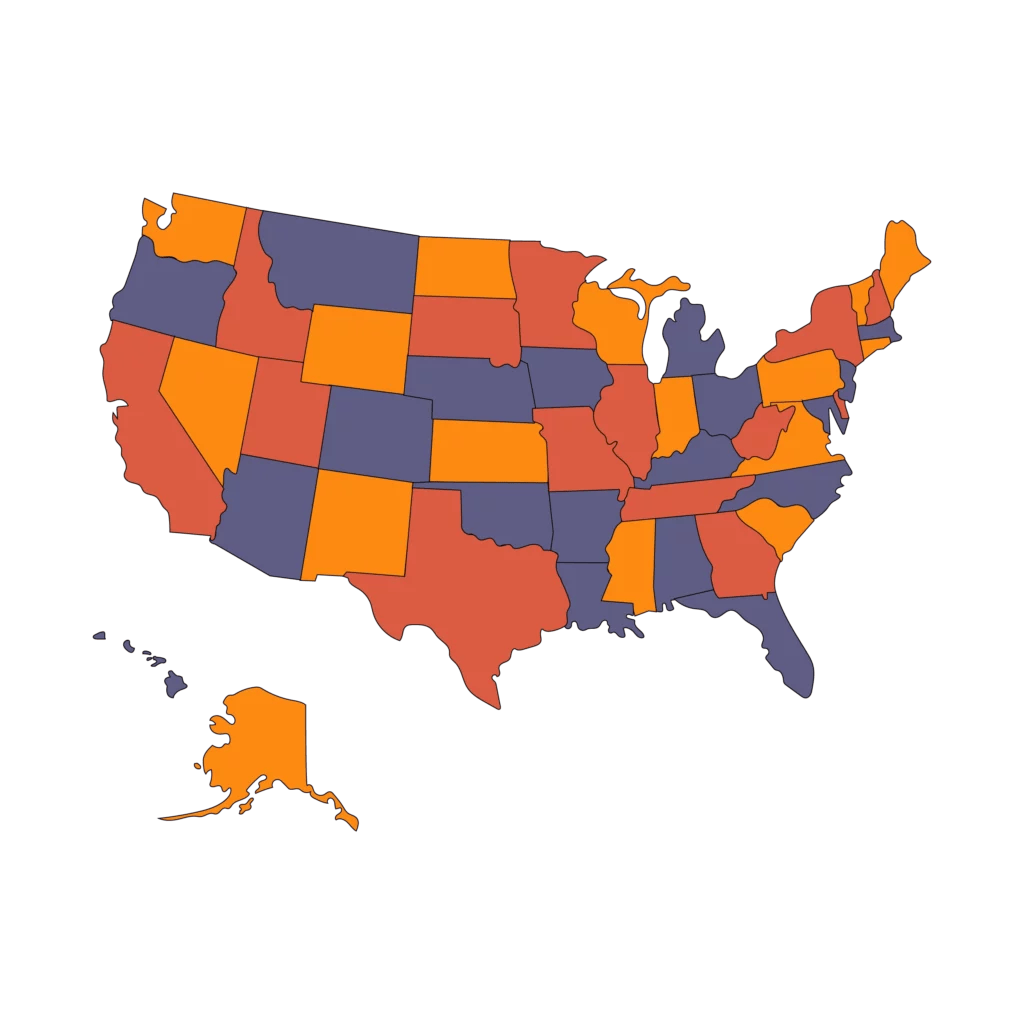

Rules vary widely by state and industry, so it’s crucial to check your state’s guidelines. Use the links below to see if you’re eligible for coverage through your state’s workers comp fund or if you’re required to carry coverage as a sole proprietor:

Workers comp may not apply to you yet, but real-world risks still do. ACT Insurance helps solo owners protect the business you’re building — at markets, in studios, on-site, and online — so when you’re ready to hire, you’re ready to grow.

Learn more about ACT GO vs ACT Pro and discover which is right for your business. Then, get a free, no-pressure quote to explore these coverages and more.

Prefer to talk it through? Connect with a licensed agent at 844.520.6991 — we’ll help you choose the right protection for where your business is today (and where it’s headed).

Usually, no. Many states don’t require solo owners to carry workers comp, though there are exceptions (construction, for example). When in doubt, check your state rules and ask our licensed agents — we’ll help you sort it out fast!

If you’re not required or eligible to carry workers comp, you may be able to provide a state-issued exemption/waiver instead. Use your state link above to request it, and ask if pairing that with your general liability Certificate of Insurance (COI) will satisfy their requirements.

In many states, workers comp becomes mandatory as soon as you have W-2 staff — even one part-time employee. You’ll need to secure workers comp coverage before they begin work.

Workers compensation pricing depends on your class code, your state’s rates, and state-set payroll minimums/maximums. For optional owner coverage, your state fund or assigned-risk plan can provide estimates.

No, general liability and workers comp are different policies. If you’re exempt from workers comp, ask whether an exemption/waiver plus your general liability COI will do the trick.

You’re in the right place! Most one-person businesses start with general liability. Depending on your work, you may also need Data Breach Protection, Workshop and Class Coverage, and Tools, Supplies, and Inventory Protection. Our licensed, non-commissioned agents are ready to help you customize your policy to fit your needs!